The new oracles and fortune tellers of our world are data-driven. Today, those who know how to analyze cryptic datastreams, and can draw insights from them, are forging their own destiny. When it comes to email analytics, nothing beats the Ongage analytics suite. Here’s how to use it.

Let me start by saying, email analytics is pretty easy.

There’s nothing magical about understanding your data, you just need to understand what you’re looking for, and where to look for it.

Since the dawn of time, humans have tried to understand the patterns of the world and to harness the potential that their insights could bring.

Today, patterns and potential are measurable, and we have new tools that make our quest much easier. Machine learning and modern analytics parse complex patterns in seconds, delivering actionable insights and making connections that we might not recognize on our own.

These data-driven insights now inform decisions on everything from what to wear to (you guessed it) how to create a highly converting/engaging/deliver-ing email campaign.

It’s like finally having that mythical crystal ball, only better.

Before we were able to harness the power of analytics, we relied on some – well – less scientific methods to guide our decision-making. From gut feelings to oracles, seers, crystal balls, you name it.

Strange way to gain insights, right? Not exactly data-driven. It was hugely popular, though.

The thing about magic wilders and oracles, aside from the smoke and theatrics, was that they gave famously cryptic answers.

For instance, King Croesus consulted Pythia, the most famous oracle in Ancient Greece, the day before a battle and she told him that a great empire would fall the next day.

That was true. A great empire did fall the next–Croesus’ empire.

You can’t blame Croesus really, thousands of people visited Pythia and other oracles every year in the ancient world. Even Alexander the Great – a brilliant strategist – delayed his conquest of Libya until he had a chance to consult an oracle, so don’t dis.

If only the King had sought a more data-driven answer. Maybe a comparison of the size, training and positioning of each army would have been more helpful. Oh well, it’s all ancient history now.

Of course, sometimes even today, it can seem like the answers you get from your data can be a little cryptic. Good analytics solves this problem. With the right data and the tools to analyze it, you can get the full story–not just half of it, even if it isn’t the story you hoped for.

To develop as an email marketer, you need that full story.

Sound data, email analytics and insights drawn from them are the tools we use to learn and continually improve, making fully-informed decisions.

In this post, we’ll conquer the world of email analytics. You’ll discover the metrics that reveal how your campaigns are performing and how to measure them. Then we’ll press forward and uncover how to use your email engagement metrics to test new campaign strategies.

How do you analyze email data?

When ancient answer seekers approached an oracle, they usually had a specific question in mind. The question might be something broad like, “Will I find happiness in the future?” Or, like Croesus, they might have sought a very finite answer such as “Will I marry my true love tomorrow?”

Since seeing an oracle was kind of a big deal, and it usually costs some type of tribute, people didn’t waste their chance asking questions that didn’t matter. In other words, they were seeking critical or key answers.

When you dig into your email campaign analytics, you should be seeing key answers, too.

Gaining actionable insights requires focusing on the metrics that matter. If you want to know how well your email campaigns engage your subscribers, that means looking at your engagement KPIs.

As MyJobHelper Founder and CEO Joshua Blumenfeld explains:

“To scale your email operations and successfully connect with millions of subscribers each month you have to track and measure your metrics and continuously improve the content you’re emailing.”

Once you know your email campaigns’ metrics, your analytics suite:

- Can help you identify patterns, shore up weaknesses, and test new strategies.

- You can use the knowledge you gain to evaluate your performance against others in your industry and between your campaigns.

- You can make data-driven decisions that deliver results.

With that in mind, here’s a list of the key metrics that reveal your email campaigns’ engagement performance.

First metrics set: delivery and deliverability rates

Are your emails making it to the inbox?

Before your subscribers can engage with your email campaigns, they have to receive your emails.

To find out if you’re reaching your recipients, search for indicators in your email analytics module that will help you to determine if subscribers are getting your emails.

If the answer for the first question is a yes, your next task would be to identify if these emails are making it into their inboxes.

The following metrics will provide the answers you seek:

Bounce rates

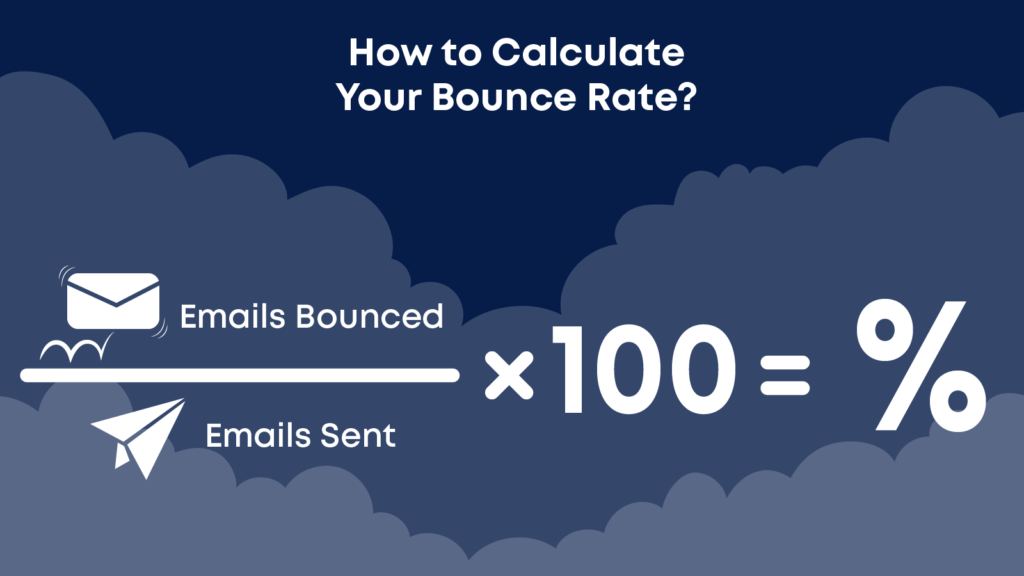

This metric is sometimes referred to as your “missing rate” and is used to measure how many sent emails were rejected before delivery (bounced back to you) or otherwise went missing.

To calculate your email bounce back missing rate, divide the total of your bounced emails by your total send amount, then convert this number to a percentage.

The inverse of your bounce rate is your delivery or acceptance rate.

Your Ongage dashboard and snapshot reports will include these metrics for each of your campaigns.

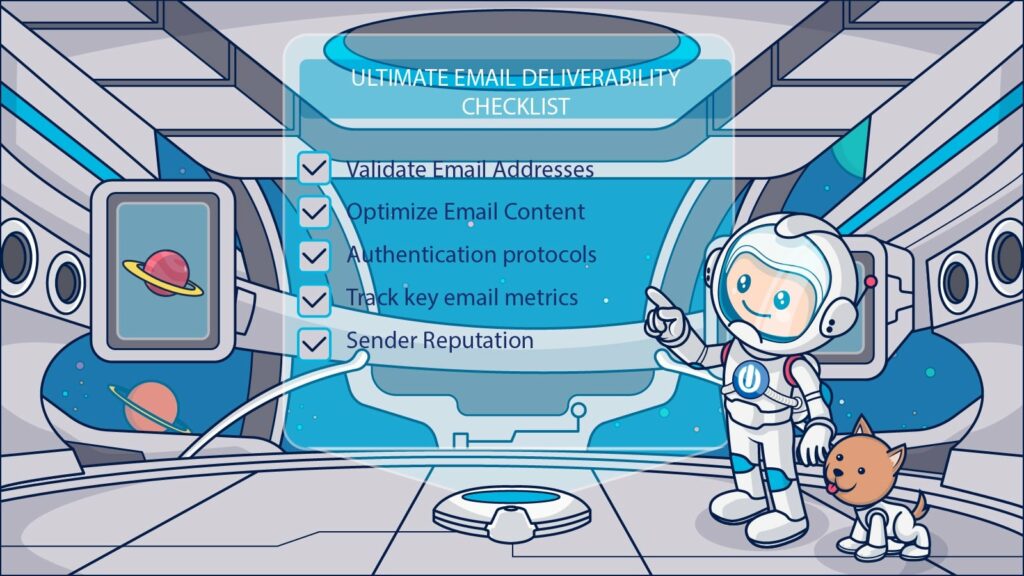

Bounces, particularly hard bounces which indicate a permanent problem, represent failures to reach the mailbox. Watch these rates and try to keep them as low as possible by maintaining up-to-date mailing lists and practicing good email hygiene to eliminate invalid emails and spam traps.

Inbox placement rate

This is, of course, where you want to be.

The inbox placement rate (IPR) counts only those emails that arrived at their destination and didn’t get filtered into the recipient’s spam folder.

The metric indicates your campaign’s deliverability and includes emails that reach the main inbox or a subfolder, such as Gmail’s Promotions or Social tabs.

Calculating this rate requires subtracting hard and soft bounces, emails that received spam complaints, and emails filtered to spam by the subscriber’s IPS or mailbox service from the total number of emails sent.

You can collect anonymized data about your domain’s mail volume, delivery success, and complaint rates from Google Postmaster, Verizon Media Postmaster Tools, or Microsoft Smart Network Data Services (SNDS) to help you estimate your IPR.

If your emails aren’t making it to recipients’ inboxes, there are several steps you can take to improve from authenticating your sender domains to scaling your sends strategically. Check out our deliverability guide to find your fix.

Delivery and deliverability metrics are an important first step in assessing the viability of your email campaign. However, like the prophecy delivered to our ill-fated Croesus, these metrics alone don’t tell the full story.

Second metrics set: open and subsequent action rates

Do subscribers want to read your emails?

Your emails arrived, but will they get opened? The key to answering that question lies in looking at what happens to them after they reach your subscribers’ inboxes.

- Are the messages opened?

- If so, does the subscriber accept and read them?

- Or mark them as spam?

To get to the root of your engagement inquiry, you’ll need to dig into these metrics:

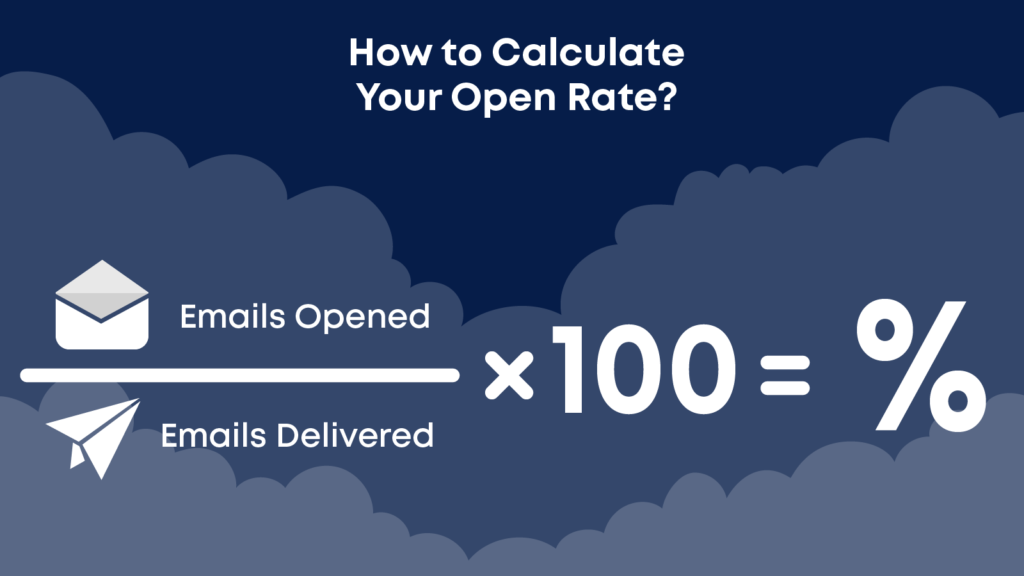

Open rate

This is your baseline engagement metric. It simply measures whether the email was opened or not. It is calculated by comparing the number of emails opened to the number of emails delivered.

Open rates may be presented as unique open rates (UNO) or reopen rates.

A single user’s open is only counted as a unique open once per email, no matter how many times they read it. Reopens represent total opens, including every open by a single user.

The Ongage’s email analytics suite allows you to track both of these rates for your email campaigns.

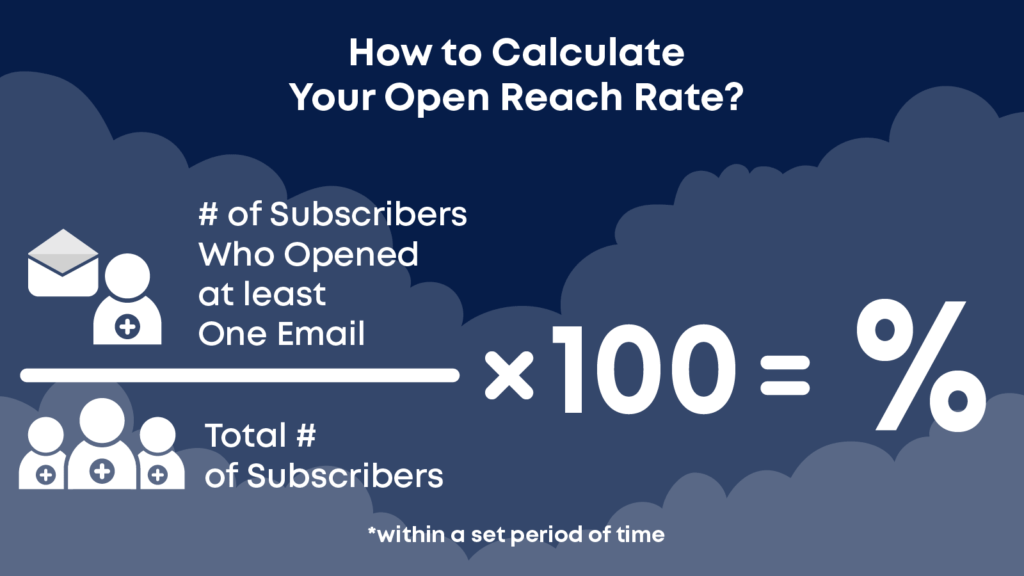

Open reach rate

Looking at your open reach rate gives you another perspective on engagement, examining how well you are sustaining engagement with your list over time. To calculate this metric you will divide the number of subscribers who opened at least one email during the selected period by the total number of subscribers who were sent one or more emails during that time.

Your open rate reveals the percentage of emails opened during a campaign. Your open reach rate tells you the percentage of your total subscribers on your list have engaged with your content.

Are your emails resonating with the same small group of subscribers over and over again or are you able to appeal to much of your list using a series of campaigns?

Compare your open and open reach metrics to find out.

What open rate indicates good engagement?

Email open rates vary significantly between industries and by type. Transactional emails usually have a higher open rate than promotional ones.

Rates may fluctuate over time as well. For example, between January and May of 2020, Acoustic reported global rates among its Campaign customers that ranged from as low as 14.7% to as high as 19.4%.

To set your campaign performance objectives, look not only at industry-specific benchmarks but also your previous campaigns’ performances.

Should I use open rates as a KPI for engagement?

While open rates set the baseline for your engagement rates, relying on them too much can be a mistake.

First, opens are merely that, subscribers that open your emails. While there’s some correlation, an open doesn’t necessarily indicate a click or conversion, which are the main KPIs you should be after.

Further, open rates are prone to inaccuracies. The reporting of open rates stands and falls by a tiny 1×1 pixel. When it loads, the pixel fires back to your email marketing platform and reports that an open has occurred.

It’s a great idea, but sometimes the pixel fails to fire. It can be because images are blocked, and the pixel won’t load. Or because the subscriber is using a text-only version of the email with no images.

Then, you have the issue of false positives, causing a spike in your open rates that’s not really there. It happens when an email client previews a message, driving the pixel to fire without the subscriber intending to read the email.

All of these issues have existed for years, and marketers have learned to live with them. But Apple’s new Mail Privacy Protection policy might be the final nail in the coffin. It’s expected to create a surge of false positives for email marketers, rendering the reliance on the open rate metric problematic.

While looking at the open rate metric might be a thing of the past, you still need to think about how to get subscribers to open your email.

How can you raise your rates?

Look at your emails from your subscribers’ point of view and focus on what they see before they open your email. Make sure your subject line clearly communicates that there’s value inside your email.

Customize your preheader text so it complements your subject line and makes subscribers want to see more. Also, let people know who the email is coming from.

Leverage a Brand Indicators for Message Identification (BIMI) specification along with other authentication protocols to add a visible logo next to your emails in subscribers’ inboxes and experiment with using an individual name versus sending your emails as a brand.

Open rates are a stepping stone in your engagement discovery quest. Unravel more of the story by looking at these metrics that reveal what your recipients do next:

After-open rejections

Remember Croesus and how he mistook the oracle’s prediction? Opened emails aren’t always good news for your engagement. Review your unsubscribe and marked as spam (a.k.a. spam complaint) rates to find out what’s really happening.

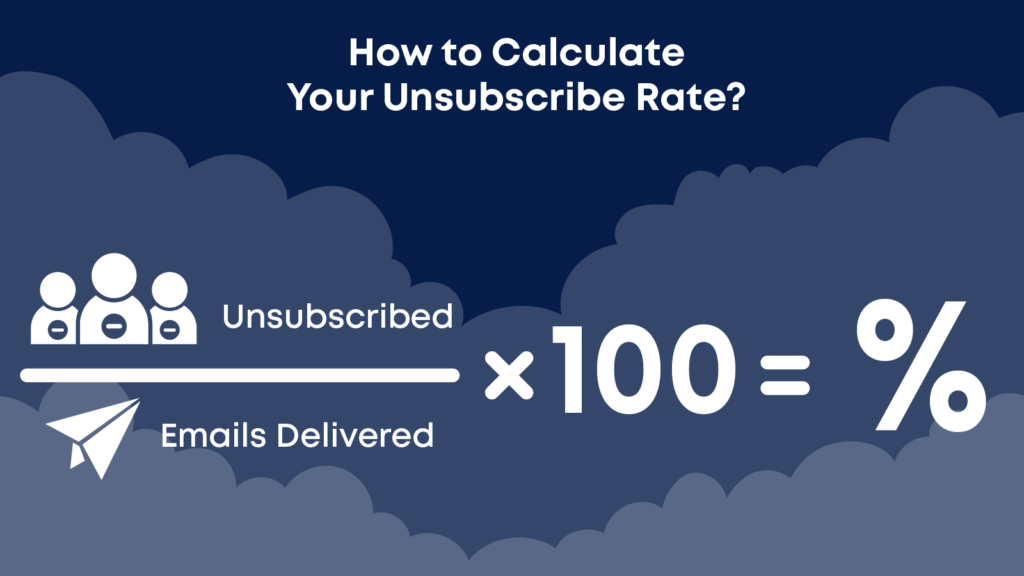

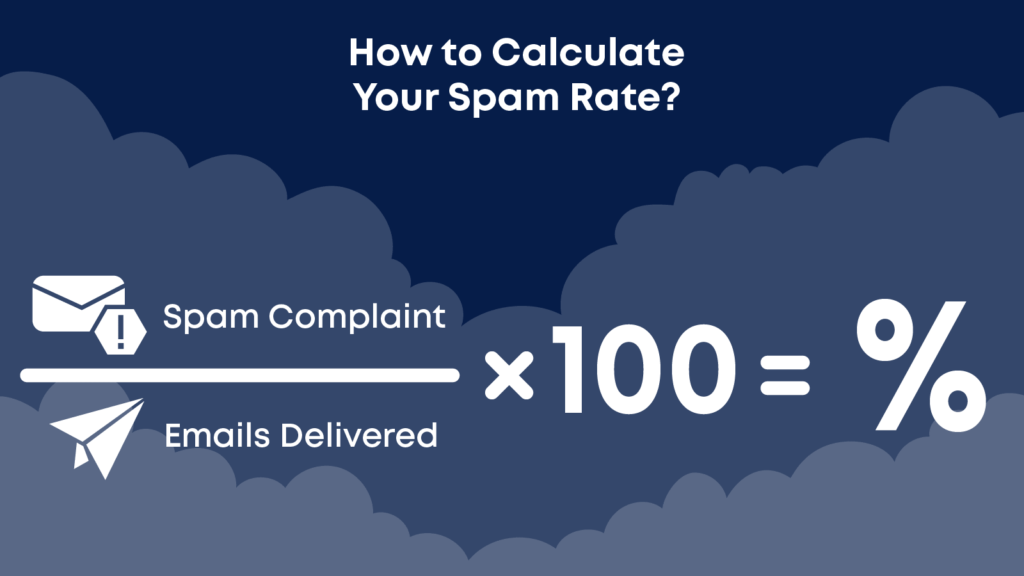

Both of these rates are calculated by dividing the total number of each type of action (unsubscribe or complaint) by the number of emails delivered, then multiplying the result by 100 to get a percentage.

You can also find these metrics by checking your campaign snapshot report via your Ongage dashboard.

Looking at these two metrics can tell you not only how many recipients didn’t like what you sent them, but also give you some insight into just how much they didn’t like it. Spam complaints are a sign that even a novice oracle can interpret.

If more than 1% of your emails are being marked as spam, it’s time to put your email house in order–fast.

Spam complaints usually come from people who didn’t sign up for your email or don’t remember signing up. Recipients who can’t figure out how to unsubscribe easily may also mark your emails as spam as an alternative to opting out.

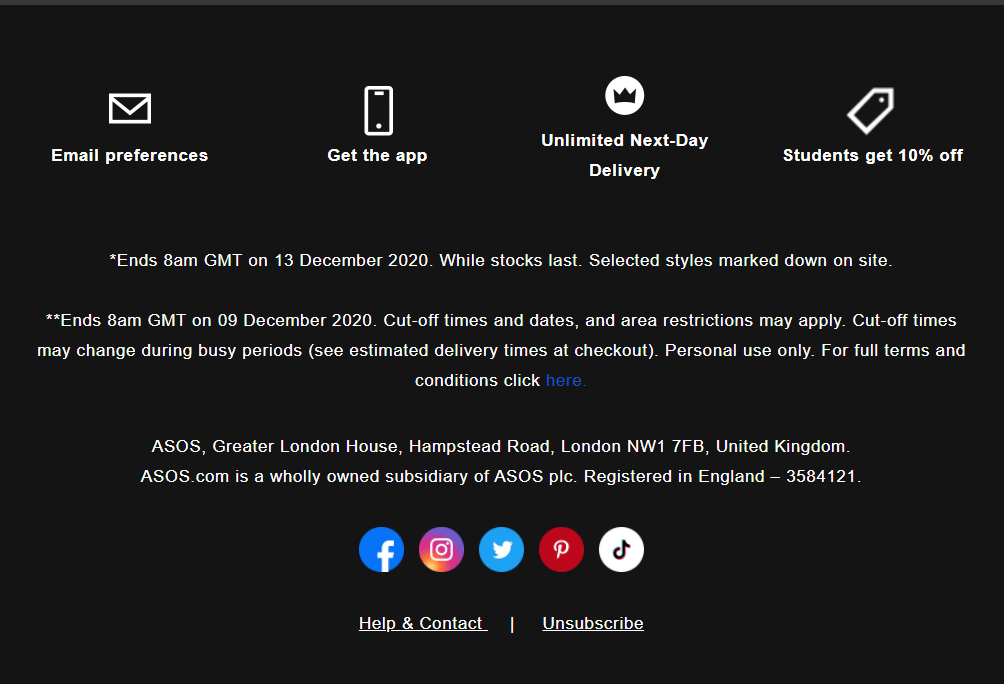

To keep your unsubscribe rate, and more importantly, your spam complaints low, make sure that you only send emails to genuine subscribers–don’t purchase email lists. Also, provide your recipients with an easy to find and click unsubscribe option and include footer text that explains why they are receiving a message from you.

Positive post-open actions

There are actions after opening that predict good fortune, too. If a recipient adds your sender address to their favorites or contact list, or rescues your email from the dungeon by flagging it as “not spam,” that means they like you. 🥰️

How do you gain your subscribers’ affection? With content they’ll love.

Use email personalization to send them tailored, targeted emails that deliver what the subject line promises.

Your subscription rate is another way to gain insight into how well your emails are being received. But, if you don’t ask the right questions this number can be deceiving.

A fairly straightforward number, your subscription rate represents how many subscribers are on your email lists. If this number is steadily growing, you may think it’s all good on the engagement front.

However, to understand exactly what’s happening, you need to compare your subscription rate to your unsubscribe rate. How many subscribers are churning each period?

Gaining new subscribers isn’t a win unless they stick around long enough to engage.

Like open rates, churn rates vary.

Expect some of your subscribers to opt out shortly after joining your list and others to fade away over time. Use your email analytics access to help you determine if new subscribers are leaving you right away or if it’s your long engagement game that is lacking.

Also examine your lapse rate to determine if you have subscribers who are steadily becoming less engaged.

Monitor and segment your email list by how often individual recipients engage with your emails during a specific period. Then, decide how to react.

For example, these subscribers might respond better to a different email cadence or frequency. Or, a re-engagement campaign to regain their attention might be the path to take.

After you attempt to re-engage, take a look at your relapse rates. This will tell you how many subscribers you’ve won back–the perfect KPI for a re-engagement campaign.

Getting subscribers to open your emails and signal that they want to keep hearing from you are positive steps toward campaign wins. Ultimately, though, you want your subscribers to take action. This next set of metrics will tell you if you’ve achieved your goal.

Third metrics set: click-through and conversion rates

Were your subscribers interested in what they saw?

We’ve covered the KPIs that will tell you whether you’re reaching your subscribers. Now, let’s look at the KPIs that will tell you if you’re connecting with them.

Does your email campaign inspire action? The following metrics will tell you.

Click-through and click-to-open rates

Your email’s subject line and preview captured the recipient’s attention and you earned an open. But you need more data to determine engagement. Click-through and click-to-open rates tell you whether your email convinced the recipient to take the next step on the journey you’ve laid out for them.

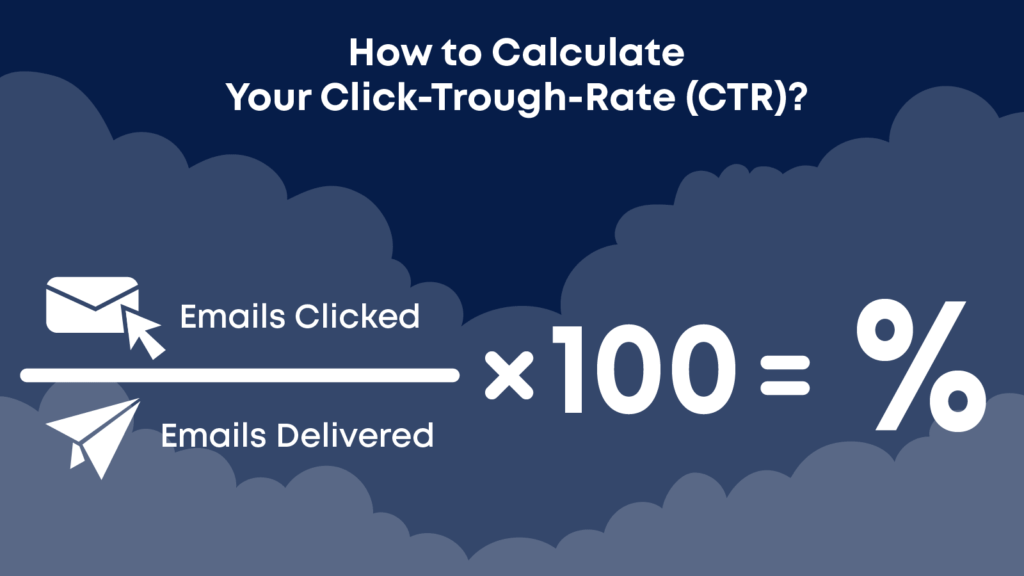

Did they click the link? Each of these metrics answers that question in a slightly different way. Your click-through rate (CTR) is calculated by dividing the number of clicks by the number of emails delivered, then converting it to a percentage.

If you want to assess the top-to-bottom success of your campaign, CTR can give you a hint. If CTR varies, your open rates may be as well.

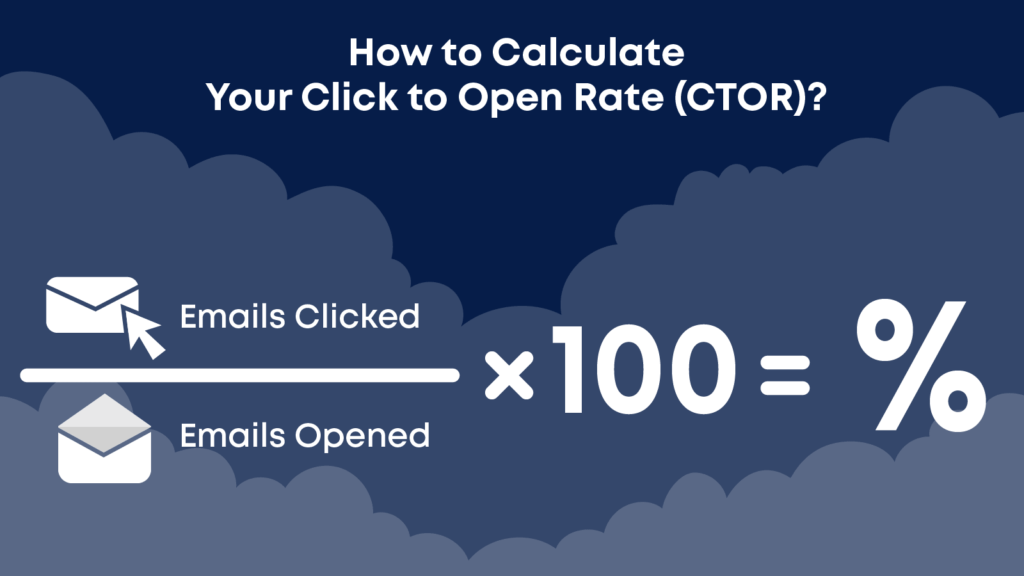

A high open rate with a low CTR, though, will give you better insights into where you may have gone wrong. This is where your click-to-open rate (CTOR) becomes the KPI MVP.

This metric represents the ratio of clicks to opened emails. Emails that were delivered but never opened aren’t included in this calculation, allowing you to assess your engagement based on the email’s content. Did your messages resonate with recipients enough to earn their click?

If your CTOR is underperforming, investigate why your subscribers were not entertained. But first, remember that your CTOR is dependent on your open rates. When looking at the CTOR, keep in mind the issues discussed previously on the accuracy of the open rate.

Then, examine your emails from the top, evaluate whether the promise of your subject was matched in your email’s copy. Were the savings inside really great? Could your subscribers even read the email’s copy?

Test your email across email services and devices and make sure it is mobile-friendly and accessible to the visually impaired. CTAs should be easy to find, understand, and tap.

Did your links work? No? Embarrassing, we know. But it happens.

Finally, today’s consumers expect value for their time. Personalization + an offer they can’t refuse is the formula for engaging, clickable emails. Use segmentation to send targeted emails that get the right message in front of the right customers.

Conversion rates

Opens are nice. Clicks are nice. What’s even better? Closing the deal.

That’s the point of this whole exercise, right? You communicate, your subscriber responds, something happens in the middle, profit!

That something is conversions. Are you getting them? How many and how often?

Measuring this metric begins with defining your conversion goal. What is your desired action and what counts as a success? Then, you need to track whether or not your email helped you achieve this goal.

There are several ways to link conversions to a particular email including using UTMs or sending specific campaign recipients to a unique landing page.

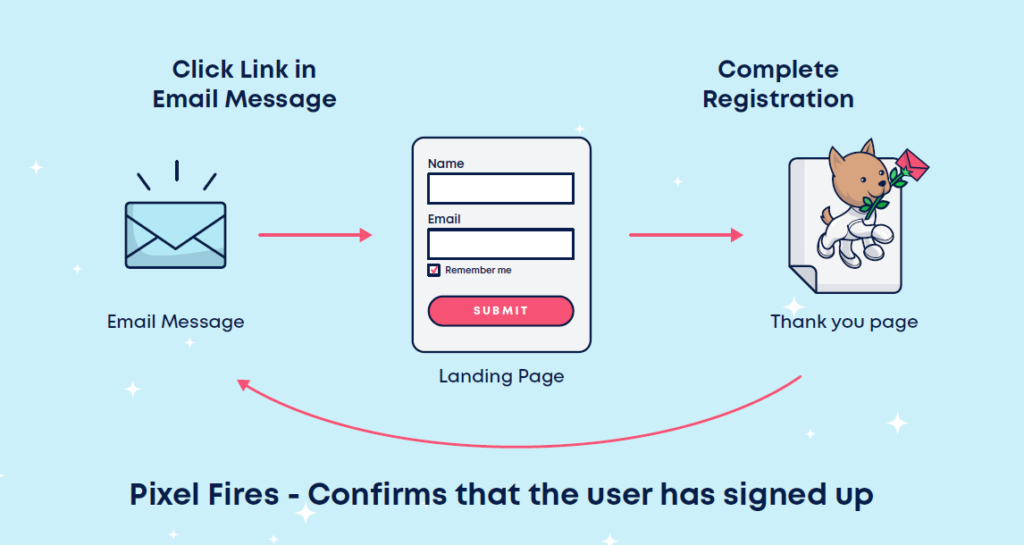

We like the convenience and simplicity of using conversion points. Conversion points are credited to an email campaign when the Ongage platform receives a pixie fire signal. Sorry, pixel fire signal. Real data, not that mystical stuff.

Pixel fires are digital messages triggered when a link with a pixel tag is clicked and the desired action associated with that link is completed. This signal tracks your recipient’s behavior beyond just their click-through to a specific page.

Actions that can be tabulated using conversion points include user registrations, demo requests, purchases, and other middle and end of funnel behaviors. You can combine conversion points with list segments to test the success of various email campaigns and conversion strategies.

Your pixel fires can light the way to new levels of understanding about your email campaigns. Did customers disengage after they clicked through from your email?

Use this data to make improvements to your landing page messaging and sign-up forms to ensure that those clicks you earned pay off.

These KPI metrics can serve as valuable signposts on your journey to email engagement success. But, there’s more to be discovered.

Advanced analytics tools enable you to gather wisdom that our ancient ancestors could only dream about. To fully harness the power of email analytics, you need to get granular.

Digging into the email analytics details

Do you wonder how those ancient oracles managed to convince everyone that they had the power to predict the future? Their theatrical presentation probably had something to do with it. Plus, as the saying goes, even a broken clock is right twice a day.

Some of their success probably came from the fact that those seeking their advice failed to choose their questions well. Asking general questions gets you general answers, like “Yes, you’ll find happiness.”

To get detailed answers from oracles or analytics, you need to ask detailed questions.

Of course, you’re more likely to get an actionable answer when it is driven by data, not guesswork. Use segmentation analysis to get those data-driven insights about your email engagements.

People’s preferences and interests are just too varied for you to appeal to everyone on your list with a single message or to understand their responses with a global KPI.

Segmentation analysis helps you identify which campaigns resonate with which audiences. The information you gain will help you refine your segments and create micro-segments, conduct A/B tests, and improve your engagement results list-wide.

You can also use segmentation analytics to pit the performance of one campaign against another or test the same campaign across different seasons.

Set your baselines, then get granular

To get into the details with segment analysis:

- Start with your core list of KPIs and establish baselines for your entire list and for each segment.

- Then track your campaigns’ performance for your chosen metrics across segments and use your email analytics to help you uncover the patterns that tell each segment’s story.

Do subscribers in one age group respond more to text-based copy than those in another group? Are mobile users clicking through at the same rate as the ones who view their emails via desktop? Do subscribers’ engagement rates increase or decrease following a purchase?

Some of the categories we see Ongage customers dive into to get more details include segments based on the recipient’s engagement level, frequency of engagement, or behaviors such as sign-ups or purchases.

Tracking performance by the SMTP or IP used to send the campaign can give you valuable insights into your email’s deliverability. Geographic location, age, and other social and demographic data are always deep mines of information on subscriber preferences.

Your segmentation analysis doesn’t have to stop with the usual suspect though.

Using Ongage’s email analytics, you can add tags to your email campaigns that identify specific characteristics that you’d like to link to your engagement metrics.

Tags can identify factors such as:

- The color scheme or images used for a campaign.

- The type of CTA or offer made.

- Or details about the subject line, or formatting.

Even better, you can generate reports that aggregate your KPI data by the fields you choose. Want to know which campaigns and/or segments delivered the highest number of conversions? You can do it. Beat that Pythia!

Create, test, reiterate and grow

Remember Croesus? After he got the answer he was looking for from Pythia, he went all in. That did not go well.

But you have modern analytics. You can test your ideas, learn from your mistakes, and continually improve–instead of losing your empire because of one bad choice.

What can your email analytics tell you about customer engagement? Try some split (a.k.a. A/B) tests and find out for yourself. Here’s how.

Choose your metric

What KPI do you want to test? In other words, what do you want to achieve? The metric you choose will be the one you compare between groups A and segment B to assess how your strategy performed.

Choose the factor you want to test.

This is the strategy element you want to evaluate. It could be a subject line, the time of day the campaign is sent, or the segments that will receive the campaign.

To test this, you’ll measure the results of a variation of that factor (B) against a control (A). You can also conduct a multivariate test (an “A/B/n test”) using several different variations of your factor.

Create test groups to send your test email to

You can create your test groups by selecting people from your entire list. However, your results will probably be better if you choose an engaged segment whose members behave similarly. Divide your list or segment so that each variation is sent to an equal number of recipients.

Create your variations

You’ll need to decide if you want to test the variations against a control for which you already have baseline results or test several variations against one another.

An example of a test against a control would be testing two new subject lines against one that you’ve already used and have metrics for.

As you create your variations, keep in mind that the more divergent they are, the more ways those differences can influence your users.

If you test your subject lines by changing the copy, adding a number and using an emoji in one and not the other, it will be difficult to determine which of those changes affected your recipients’ responses.

Send your test campaign

It’s time to see which strategy reigns supreme by sending your email variations out into the world and waiting for the results to come in. To ensure you get a good sample of responses, we recommend running your test campaign for at least one week.

Evaluate the results

After your campaign closes, analyze the performance of the metric you chose in step one. Are there statistically significant differences among the results of the different variations?

You don’t want to be like the believers who turned to oracles for advice and made decisions based on a difference that could have happened by chance!

A statistical significance test can help you determine just how much difference between results indicates that your factor really played a role.

Take action and keep learning

You don’t need a crystal ball to tell you that modern-day computing power offers you nearly endless possibilities for testing your ideas, strategies, and campaigns. Each time you gain new data, you learn.

Keep gathering knowledge. Develop a list of your most burning email engagement questions and then power your analytics engine to pursue the answers.

Email analytics – the only oracle that works

Ah, what wonderful times we live in.

We aren’t stuck with cryptic, unreliable prophecies. We can access crisp and actionable insights to guide our email marketing strategies and connect with our subscribers. The deeper and more detailed your analysis, the better those insights will be.

MyJobHelper doesn’t mince their words when it comes to the importance of analytics:

“Figuring out where things went right or things went wrong, being able to monitor engagement like a hawk, and being able to drill down into the campaigns and segments that drove positive or negative actions – all of this was vital for bringing us to where we are today.”

The bottom line when it comes to email analytics is this: you can’t improve your performance if you don’t know where you’re going right and where you’re going wrong.